Islamic Banking

Warren Edwardes , Friday 4 February 2000

Warren Edwardes is CEO of Delphi Risk Management – a London based banking innovation and risk consulting firm.

He is author of best seller “Key financial instruments: understanding and innovating in the world of derivatives” Financial Times Prentice Hall, which includes an appendix on Islamic Banking. see http://dc3.co.uk/kfi

Edwardes was previously on the board of Charterhouse Bank, has been involved with Islamic Banking since 1985 and is Fellow, Publications Advisor and Board Governor of The Institute of Islamic Banking and Insurance. Contact we@dc3.co.uk See http://dc3.co.uk/islamicbanking

Islamic Banking

Happy the man who far from schemes of business, like the early generations of mankind, ploughs and ploughs again his ancestral land with oxen of his own breeding, with no yoke of usury on his neck – Horace

Background

The London Sunday Times of February 2nd 1997 wrote: “The advent of Islamic Finance will be a Godsend for them . It could also turn out to be a goldmine for the United Bank of Kuwait”.

There seems to be considerable demand for such Islamic banking products both in Islamic countries and in the West. To date, for a number of reasons including risk-aversion and conservatism, this need has gone largely unfilled.

The purpose of this article is to provide an introduction to “Islamic” banking. It does not attempt to provide a moral justification, rationale or even establish clear rules as to what is Islamic and therefore Halal and what is un-Islamic and therefore prohibited or Haram. But even if the reader has little interest in Islamic Banking per se there are important lessons to be learned from the creative process used to satisfy the Islamic regulations. There are numerous parallels with tax-driven structuring in conventional banking markets. Throughout the article there are references to familiar Western financial instruments.

Overview

It is simply an accepted fact that there are sufficient Muslim investors and borrowers in both Islamic and non-Islamic countries to warrant the attention of traditional banks who seek to serve such clients and capture a potentially profitable slice of a still relatively untapped market. Just as interesting and useful for non-Islamic bankers are the lessons learned from the innovation and creativity applied in meeting Islamic criteria.

This article serves to clear away some of the mystery and show how some such financial products can fit alongside a conventional interest-bearing banking system and thereby serve a Western bank’s retail and wholesale clients or help a corporation that is offered Islamic funds. Some non-Islamic financial or exporting institutions may also find it prudent to use Islamic finance so as to curry favour in Islamic markets, thereby easing entry or enhancing business.

Some products are more Islamic and than others. The basic principle is that interest usury or Riba used interchangeably is prohibited on the principle of no pain no gain. What I, as a non-Islamic observer would call “pure” Islamic banking, seems to be structurally very similar to venture capital finance, non-recourse project finance or ordinary equity investment. The investor takes a share in the profits, if any, of the venture and is liable to lose his capital. It involves investing but not lending and therefore on a systemic basis is similar to the German, Japanese and Spanish banking systems rather than the British or American systems.

Just as in tax management, however, numerous products have been developed to meet the letter but not necessarily the spirit of the regulations. There are a number of grey areas. Some products that might have been acceptable twenty years ago are no longer so. Just as in the process of converting interest into capital gains for tax purposes, early Islamic investors were content to enter into zero-coupon bonds or discounted Treasury bills and receive the interest foregone in the form of capital gains.

In the mid-1980’s I dealt foreign exchange and deposit packaged transactions. The “Islamic” client bought a low interest rate currency or even gold from the bank. This was placed on deposit free of interest with the bank. At the same time the currency or gold was sold forward. But the forward rate was adjusted to reflect the fact that no interest is paid on the deposit account. The purchase, deposit and forward transaction had to be done as a package to meet the Bank of England’s rules on forward transactions at off-market rates. I have also transacted three-party circular transactions that generate locked-in returns for the “Islamic” party.

Such locked-in and predetermined capital gains is in most fiscal jurisdictions now regarded as interest for tax purposes rather than capital gains which is either free of tax or favourably taxed. Deep discount or deep gain legislation is continually being fine-tuned in many countries including the UK. Similarly such devices of converting Riba to capital gains is, in the most blatant forms, increasingly unacceptable to the Islamic authorities. Nevertheless, in my observations of the market, 95 per cent of Islamic banking as practised involves some form of pre-determination of profit or “mark-up” that, whilst acceptable to individual Islamic authorities, would now be regarded as capital gains to most fiscal authorities. But it is not for me to suggest that all such pre-determination is Haram. For some, institutions, appearances are important in terms of being seen to be Islamic in the eyes of their customers, shareholders and regulators. And even when there is a guaranteed return generated through a “mark-up” scheme, the linking to an underlying trade transaction is deemed “a good thing”. In a Western banking system Commercial Paper and Bankers Acceptances need in theory to have an underlying trade transaction. In practice the link to trade is often weak.

Just as there is no central, global fiscal authority, there is no Islam-wide authority that determines what is Halal and what is Haram. There is a danger that some banks will go around “opinion-hunting” to get Islamic approval for their schemes. I am far from suggesting that the system is corrupt. The same sort of process happens in the form of “opinion-shopping” by banks with the Big-five accounting bodies or with various tax counsel on interest-bearing structured finance schemes. Such a process is natural or just inevitable. Furthermore, just as Western banking business moves from one tax jurisdiction to another, so does Islamic banking in its less than pure forms seek approval for various schemes from more lenient authorities.

Beyond the question of interest / Riba is the ethical issue. Islamic investments exclude tobacco, alcohol, gaming and other “undesirable” sectors. Islamic investors, by and large, are motivated in their choice of investments by much the same criteria as their Western ethical counterparts. The search for acceptable investments is balanced by natural risk-aversion. Islamic borrowers, on the other hand, also demonstrate a reluctance to give away a share in the profits of their enterprise. It is not therefore surprising that nearly all Islamic banking takes the form of one type of mark-up or other rather than profit-sharing.

A Brief History

Small-scale “interest-free” savings banks were created from 1963 in Egypt. They were not overtly Islamic for fear of offending the political authorities. These savings banks neither paid interest to their depositors nor charged interest to their borrowers, investing mainly in trade and industry. The banks’ depositors were paid a share of the profits of the borrowers, acting like Savings & Loan institutions rather than commercial banks. The Nasr Social Bank, established in Egypt in l97l, was created as an interest-free commercial bank, but still without specific reference to Islam.

The Islamic Development Bank was established in 1974 as an intergovernmental bank aimed at providing development funds for projects in less well off member countries. The IDB provides fee based financial services and profit-sharing financial assistance. The IDB operations, which are free of interest, are explicitly based on Shariah principles. Gradually overtly Islamic banks were developed in the Middle-East through the late 1970’s such as the Dubai Islamic Bank, the Faisal Islamic Bank of Sudan, the Faisal Islamic Bank of Egypt, and the Bahrain Islamic Bank. Islamic banks were also developed in Malaysia and even in predominantly Catholic Philippines to serve the Muslim population in Mindanao and in India. Luxembourg has the Islamic Finance House, DMI is based in Geneva and there are Islamic financial institutions in Denmark, Australia and in South Africa.

To my knowledge whilst Western banks such as ANZ and HSBC have Islamic Banking units, the focus of attention has largely been in serving clients in Islamic countries. Muslim clients in the West are not served except by relatively small and lowly rated specialist Islamic banks.

Basic Principles

The basic aspect of Islamic banking is the absence of interest but there are other social and ethical features claimed by the more “pure” or “zealous” such as there is more to Islamic banking, such as aiding a more equitable distribution of income and wealth and avoiding undesirable areas. Some argue that the prohibition of Riba is akin to the usury laws in many Western countries or a ban on excessive interest. Thus a lax view of Islamic banking would only exclude back-street money-lenders and pawn brokers and include modern bank lending. A distinction has also been made between interest earned on passive investments such as bonds and bank deposits and interest earned on productive industrial loans. For all practical purposes, there is now no distinction between different forms or sources of interest. All interest, whether deemed usurious or not in Western eyes is Haram.

One aspect of Islamic banking that should make Western bankers both comfortable and uncomfortable is that a Koran source distinguishes between interest and trade and urges Muslims to receive only the principal sum loaned and that principal should only be taken back subject to the ability of the borrower to so repay. The distinguishing between interest and trade allows various Islamic financial instruments of “mark-up” for deferred payment or early payment discounts, trade financing commissions and leasing type transactions that fit neatly into a Western bank’s balance sheet. Creating liability structures is therefore relatively straightforward. However, the element of repayment “only if able to” makes lending an uncomfortable proposition. Close attention must be paid to the meaning of “ability to repay” and what triggers an inability to do so. Can a borrower unable to repay continue to trade? Of course, in a suitably structured Islamic trade finance transaction title to the goods may be retained by the “lender” until paid for.

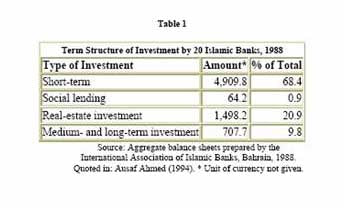

In Iran which has an Islamic only banking system, the conversion to Islamic modes has been much slower on the bank asset side than on the deposit side. Apparently only half of the resources available to the private sector are utilised and those mainly in short-term facilities such as commercial and trade transactions. In Pakistan, which has a dual system, there is also a concentration of bank assets on short-term trade credits rather than on long-term financing. The slower pace of conversion on the asset side is claimed to be the result of inadequately trained staff. To me it looks like traditional risk-aversion. Islamic loans are a good deal more risky than conventional interest-bearing, securitised loans. That, of course, is part of the point of Islamic finance. No pain – no gain.

There is no need for me to justify the need for Islamic banking services and the prohibition of interest. It just exists through the religious beliefs of a bank’s Muslim client base. One can explain away the prohibition of the eating of pork by Muslims and Jews as a result of sanitary measures thousands of years ago that were institutionalised or the Catholic eating of fish on Fridays at a time when it represented self-sacrifice but such practices are sincerely held and the reasons seldom questioned. But it is worth looking at the reasons for Islamic banking put forward by some to assist with understanding and innovation.

There are various economic and rational reasons put forward as to why interest is banned in Islam. Some say that interest as a fixed cost of production is a brake on employment. There is also a view that interest causes monetary crises and exacerbates trade cycles. Other proponents say that the unearned aspect of interest makes it exploitative of labour. But then interest is only one of many ways of generating exploitative profits. Profits are Halal under Islam. The fact that property rental is considered Halal but capital rental is not might seem inconsistent. The distinction is justified on the grounds that property rental has a determined benefit whereas capital rental does not and that property is subject to wear and tear whilst cash under a bed is always worth the same in cash terms.

Of course, money is eroded in purchasing power terms so should the inflation element of interest be deemed Halal? Perhaps, but in practice the Islamic banking authorities have not accepted the arguments in favour of indexation. Like for like must be returned to the lender – gold for gold, barley for barley, etc. So the Islamic Financial Engineering challenge is to not lend money but s omething liquid and freely exchangeable into money but guaranteed or likely to increase in line with the interest rate foregone.

The cost of capital is recognised in Islam, as a production cost but the preferential nature of interest on profits that is not deemed acceptable. Profit and Loss Sharing (PLS) with the profit sharing ratio pre-determined is, however, acceptable. But how about some form of undated Preference shares which are regarded by banking regulators as equity-like and Tier One Capital? Issuers of these shares do not have to repay the principal and can pass or not pay the fixed rate dividend if there is no dividend paid on the firms’ equity. Unlike under normal bond issues or bank lending, non-payment of interest does not lead to default. So one could argue that the rate of return is not fixed but variable and linked to the ability to repay if it can be zero if the borrower genuinely cannot afford to repay and automatically deferred until the borrower can repay.

Key Islamic Financial Instruments

Mudaraba

Under the principle of no pain no gain, no one is entitled to any addition to the principal sum if he does not share in the risks involved. The capital provider or rabbulmal may ‘invest’ through an entrepreneur borrower or Mudarib, hence the name of the structure; Profits are shared on a pre-agreed basis but losses, if any, however, are wholly suffered by the rabbulmal. This financing structure is called Mudaraba and to me looks like non-recourse project finance. Mudaraba has also been called Shirka.

Musharaka

Financing through equity participation is called Musharaka. I remember the name by likening it to share holdings. Here the partners or shareholders use their capital through a joint venture, Limited Partnership to generate a profit. Profits or losses will be split between the shareholders according to some agreed pre-formula depending on the investment ratio.

Mudaraba and Musharaka represent the desired forms of Islamic banking even though their current use is not significant. Islamic bank depositors act as Rabbulmals and place funds with the bank. The bank is the Mudarib on its liability side with respect to the depositors. The bank uses the funds on the Mudaraba or Musharaka basis or any other Islamically approved basis with clients in search of funding. Here the bank is the Rabbulmal with respect to the end users of the funds. Under such a scenario the bank acts as a principal. The bank may also act in an off-balance sheet capacity as a fee earning agent on behalf of the fund providers and/or fund seekers or as a traditional fund manager investing in a diversified portfolio of Musharaka contracts.

Retail Islamic Banking Products

At a retail level, Islamic banks provide current, savings, and investment accounts.

The current account is basically a safekeeping or Alwadiah account and used for day to day cash management. It is very similar to such accounts in conventional banks. No return is paid to depositors. The instant access accounts allow the depositors to withdraw their money on demand and permit the bank to use the depositors’ money. Cheque-books are provided along with bill payment facilities, bank drafts, bills of exchange, travellers cheques. Credit cards are unlikely to be provided but debit cards do not seem to be a problem. Most banks have no charges for such accounts.

Alwadiah structures are also used for higher return savings account. Banks may as they see fit pay the savers a return, depending on their own profitability. This seems to be allowed as the bank’s payment, if any, is level and is not determined in advance. Savings account holders do not have the same level of service as current account holders but get savings books and instant or short notice access. There may or may not be a service charge incurred. Losses are not, in practice, passed on to depositors and are absorbed through the banks’ reserves.

The investment accounts use the Mudaraba format. Deposits are fixed term and cannot be cashed in before maturity. The profit-sharing ratio varies between institutions and could be a function of the bank’s profitability or that of the portfolio of end borrowers. In practice there is only profit sharing and no loss sharing for retail investors. The lower risk means a lower profit share.

There are considerable variations on the Mudaraba principle. The Islamic Bank of Bangladesh has been offering Profit and Loss sharing Deposit Accounts, PLS Special Notice Deposit Accounts, and PLS Term Deposit accounts. Bank Islam Malaysia provides wholesale and retail investment accounts both on the PLS principle. The frequency of payment is another variable. Profits are declared and distributed monthly in Malaysia, whilst in Egypt there is a quarterly distribution. In Bangladesh and Pakistan distributions tend to be half-yearly.

A common thread is the short-term liquid nature of the deposits. Long-term mortgage-type finance is hard to come by. The longest term deposits appear to be raised in Malaysia. Even there almost all the deposits are under two years in maturity.

Murabaha

As I indicated earlier, the vast majority of Islamic financial transactions measured by principal does not involve a share of profit but generates a locked-in return. The Mudaraba and Musharaka transactions are often seen on the retail liability side of Islamic banks. The asset side, retail and wholesale is a good deal risky. The most common such financial instrument is the ‘mark-up’ structure called Murabaha. I liken it to the similar sounding “repo” or sale and repurchase agreement used in the West. The only Islamic transactions that I have personally concluded have been of the Murabaha type.

In a Murabaha transaction, the bank finances the purchase of an asset by buying it on behalf of its client. The bank then adds a “mark-up” in its sale price to its client who pays for it on a deferred basis. The ‘cost-plus’ nature of Murabaha sounds very much like the interest into capital gains manipulations of tax-avoiders. Islamic banks are supposed to take a genuine commercial risk between the purchase of the asset from the seller and the sale of the asset to the person requiring the goods. The bank stands in between the buyer and the supplier and is liable if anything goes wrong. There is thus some form of guarantee with respect to the quality of the goods provided by the bank to the end user in the strict form of Murabaha. Title to the goods financed may pass to the bank’s client at the outset or on deferred payment. It is argued that the services provided by Islamic banks are substantially different from those of money lenders.

Baimuajjal

It is deemed acceptable to charge higher prices for deferred payments. Such transactions are regarded as trades and not loans. Property financing on such a deferred payment basis is called Baimuajjal.

Ijara

An Islamic form of leasing is called Ijara. Here the banks buy machinery or other equipment and lease it out under instalment plans to end-users. As in Western leasing there may be an option to buy the goods built into the contracts. The instalments consist of rental for use and part-payment.

Baisalam

When a manufacturer seeks to finance the production of goods he seeks Baisalam financing. This involves the bank paying for the producer’s goods at a discount before they have been delivered or even made. It is thus similar the Bankers’ Acceptance financing in the West.

‘Certificates of sale’

It has been suggested that consumers buying consumables on credit would issue ‘certificates of sale’ similar to letters of credit. These could be encashed by the seller at the bank at a discount. This seems very similar in structure to Baisalam.

Prizes and bonuses

Iran and Pakistan have both attempted to fully Islamise the entire banking. Iran converted to Islamic banking in August l983 with a three-year transition period. In Iran banks accept current and savings deposits without paying any return. The banks are permitted to offer bonuses and prizes on these deposits very similar to the UK’s premium bonds. This is apparently not regarded as gambling by the Iranian Islamic banking units.

No fee accounts

There is a substantial Muslim population in South Africa and they are serviced by two small Islamic banks. The main product being offered is the “no fee” current account which is also provided by the conventional banks by arrangement. Transaction charges are waived and interest is not paid on current accounts. Interest is charged on loans by conventional banks.

‘Gifts’

Gifts to depositors are given entirely at the discretion of the Islamic banks on the basis of the minimum balance. These gifts may be monetary or non-monetary are based on the banks returns.

Key Features of Islamic Banking

An analysis of the products suggests that Islamic banking six key features:

It is free of interest

It is trade related and there is a perceived “genuine” need for the funds.

In its purest form, it is equity related

It is meant to avoid exploitation – no usury

It invests ethically

There are retail and wholesale applications

Interest free

The avoidance of interest has been abused by those who merely seek to be seen to be Islamic bankers. Many convert interest into capital gains and find a Koranic justification. The rules have been tightened progressively as they have been in tax avoidance.

Trade related

I am not going to criticise devices converting interest to capital gains as all such instruments have to show some underlying commercial need and therefore probably go some way towards the Islamic objectives. There are Western parallels with Commercial paper and Bankers Acceptances which also have to be trade related. Many emerging markets, under their exchange control regimes, insist that all overseas financing or foreign exchange transactions have to be trade related.

Equity related

It has been suggested that “pure Islamic banking” involves profit and loss sharing or equity participation in the Mudaraba and Musharaka forms. There is no pre-determined interest income for the lender, or in this case, the investor. The investor’s return is uncertain. Sounds good and just the sort of venture capital financing many in the West have been demanding of their risk-averse banks.

I am reminded of the UK’s “Section 233 loans” developed soon after I started my banking career with Barclays Bank in 1979. Very simplistically, it was deemed by the UK tax authorities in Section 233 of the taxes act that if the borrower’s payment was not fixed but linked to the current income of the firm then the payment was not “interest” but was “dividend”. Dividends and interest were and are still treated differently under UK tax law. UK banks were, by and large, lenders and not equity investors. So the dividend income was useful in being used to offset dividend payments to the banks’ own shareholders. Similarly there were indebted companies that were unprofitable in the UK but profitable overseas. So by converting interest to dividends they were able to offset overseas dividend income with the new UK dividends payable to UK banks. So we created a “preference share” type of product where the dividend payable on the debt was the normal market interest rate payable by the firm plus a minuscule percentage of the firm’s profits. The rest is history. We got away with it until the Inland Revenue changed the rules. Could such a product with a nominal linking to profitability be deemed to be Islamic? Maybe.

So devices can be created so that pre-determined “interest” can be made to look like pre-determined capital gains. Also a tiny bit of uncertainty may be introduced into the equation. But there is also a requirement to avoid exploitation. What if under a profit sharing arrangement, because of the entrepreneur’s poor bargaining position and the banker’s monopoly status, the bank received 95 per cent of a venture’s profits. Would this be deemed Islamic? Perhaps. There do not appear to be rules that determine fair sharing ratios of profits.

Usury – An international review

Some say that prostitution is the oldest profession; history actually suggests that the oldest profession may indeed be that of the moneylender – Martin Armstrong, Princeton Economic Institute.

Under the current interpretation of the rules governing Islamic banking, Usury and Riba are regarded as the synonymous. The prohibition is on interest and not just on usurious interest. In practice, there appears to be more emphasis on the prohibition and restructuring of interest than on the potentially exploitative aspect of financing.

It is worth noting there is nothing new or particularly Islamic or Christian about Usury or interest controls. In 24th century B. C. Manu established a rate ceiling of 24 per cent in India. Later, Hammurabi, King of Babylon, authored laws around 19th B. C. established a cap on lending rates. On loans of grain, which were repayable in kind, the maximum rate of interest was limited to 33 1/3 per cent per annum. On loans of silver, the maximum legal rate was 20 per cent although it appears that in some cases rates of 25 per cent per annum were charged. The law remained for most of the next 12 centuries but as with any law “regulatory arbitrage” took place and was subsequently eliminated. Unfair practices also existed.. For example, creditors were forbidden from calling a loan made to a farmer prior to harvest. If the cro p failed due to weather conditions, all interest on the loan would be cancelled for that year. In the case of houses, due to the scarcity of wood, a door could be used as collateral and was considered to be separate from a house. The 6th century Greeks, through the laws of Solon, lifted all maximum limitations on the legal rate of interest a moneylender might charge. The temple at Delphi was the “City” or “Wall Street” of the Greek Empire lending money for interest regularly. Credit regulation was once again part of the legal code at the start of the Roman Empire. The legal limitation on interest was established at 8 1/3 per cent per in the 5th century B.C. Julius Caesar’s attempts to control interest rates could well have been the real reason for his assassination since many the Roman senators were the main moneylenders. (source: A Brief History of World Credit & Interest Rates, 3000 B.C. to the Present, by Martin A. Armstrong, Copyright Princeton Economic Institute 1987)

Back to the present day, quite a few Western countries have Usury laws that prohibit excessive interest rates. The UK’s usury laws which prevented “excessive” interest were abolished in 1854. South Africa and the US still have usury laws. Usury results when a lender charges more than the legal amount of interest permitted in that geographical area. Usury percentage limits vary by state, and at least one state, Virginia, has no usury limit. Today most of the states have had their ability to limit interest rates curtailed by over-riding US Federal law. Higher than permissible rates have been regarded by US Federal banking authorities as penalty fees and insurance premiums. And the federal rate limits are high.

In some states there is no restriction on the rates used for lending to incorporated entities. The controls are often on lending to persons. The usury rate usually is variable depending on market rates. In September 1998 in North Dakota it was 10.556%. California has recently imposed strict consumer lending limits. But these only apply to state banks and not to national banks. The California Constitution allows parties to contract for interest on a loan primarily for personal, family or household purposes at a rate not exceeding 10% per annum (compound annual percentage rate). The allowable rate in California is 5% over the amount charged by the Federal Reserve Bank of San Francisco on advances to member banks on the 25th day of the month before the loan. The usury laws do not apply to any real estate broker if the loan is secured by real estate. This applies whether or not he or she is acting as a real estate broker. The limitations also do not apply to most lending institutions such as banks, credit unions, finance companies, pawn brokers, etc. State laws place limitations on some of these loans, but at a higher percentage rate than the usury laws listed above.

Time payment contracts such as retail instalment contracts are not generally treated as loans and the usury laws normally do not apply to them. There are no limits on finance charges for the purchase of personal, family and household goods or services at this time. The maximum interest rate for car loans is almost 22 per cent. Banks also treat interest charges for third party credit cards such as Visa, MasterCard and American Express as not being subject to Usury law limitations.

In transactions for the purchase of goods or services which are not for personal, family or household purposes, there are normally no limits to finance charges except those set by the parties. Limited liability companies and limited liability partnerships can no longer assert usury as a defence in civil recovery actions. The usury interest limit that applies to limited liability companies and limited partnerships has been raised from 30 per cent per annum to 50 per cent per annum to equate to the level that applies to corporations.

But there is a problem with usury laws as I saw them in South Africa. If there is a particularly risky investment and an interest rate limit, then banks will simply not lend. The poorest will find themselves deprived of financing and under a free market there will be a shift to quality or to those that do not really need financing. Unless there is government imposed mandatory or tax driven lending to certain sectors or public opinion pressure, certain sectors or individuals deemed risky by the banks will simply not get the funding required.

The emphasis on equity type transactions in Islamic banking, especially the Mudaraba mode, has been criticised by some. In that it does not address the exploitative issue.

Ethical investments

Islamic investments have to avoid undesirable sectors. In that it is little different from many Western Ethical investment funds. Ethical Financial is a UK investment adviser that arranges ethical investments for private clients. In its 1997 brochure Ethical emphasises the following areas investment guidelines:

Environment protection;

Charitable giving;

Community involvement;

Exclusion of factory farming;

Vegetarian and/or vegan inclination;

Human dignity and sanctity of life;

Exclusion of companies involved in activities such as pornography and armaments;

Shareholder influence in bringing about change in company practices.

Other than the exclusion of alcohol and gaming related companies, which are not specifically mentioned, Ethical’s objectives are remarkably similar to the objectives of many an Islamic investment fund.

There are retail and wholesale applications

Islamic investments apply to wholesale and retail clients. In the West, retail Islamic investments are only offered to high net worth clients. For example Robert Fleming offer the Oasis Fund with a minimum subscription of USD 50,000. There seems to be a surprising absence of products available to European Union Islamic retail clients. There are 1.2 million Muslims residing in the UK and even larger numbers in France and Germany. AL-Bait (The International Investor) in association with Pictet & Cie, also offer high net worth Islamic products. Arab Bank offers an investment account, but again with min sub of $10,000. The Halal Mutual Investment Fund, however, has set up a unit trust with a minimum of £250. But it is far from a household name. Amongst major European banks I am only aware of Barclays Private Bank that offers Islamic Accounts but then only to its high net worth clients.

Islamic Investment Banking Unit at the United Bank of Kuwait in London offers Halal mortgages. But so far market penetration has been limited.

Islamic Derivatives

It is generally assumed that the term “Islamic Derivatives” is a contradiction. The requirements of derivatives and rules of Shariah at first sight are diametrically opposed and all derivatives are therefore Haram. But it is important to recall the generalised definition I use of a financial derivative. It is simply a financial instrument that is derived from another financial instrument or a combination of such instruments. It is argued that as derivatives “unquestionably” involve interest or interest-based products they are contaminated and should be prohibited. Well derivatives only involve interest if one or both parties using the derivative seeks to hedge the derivative. It could be argued that Murabaha could involve interest if the parties seek to match the interest free but guaranteed return product with an interest-bearing equivalent. Islamic banking derivatives should be perfectly acceptable so long as they do not involve interest.

In Malaysia there is a dual financial system. An Islamic banking system works alongside a conventional interest bearing banking system. But there is only 1 purely Islamic bank compared with 26 dual system banks offering Islamic windows. These dual system banks do not completely separate the Islamic banking units from the rest of the bank and there is inevitably a crossover of the effects of derivatives from the conventional system into the Islamic system. Most of the research into the acceptability of Islamic derivatives has been accordingly carried out in Malaysia. There have also been developments in Bahrain.

I would argue that Baisalam, which involves the pre-payment for goods, is indeed an Islamic banking derivative and can be regarded as a kind of forward contract. I would argue that it boils down to intentions. Alcohol is prohibited under Islam. But Alcohol is used as a disinfectant in surgery. Alcohol is also used as anti-freeze in cars. Wheat futures can be used as a gambling tool. But wheat or oil futures as used by farmers or oil producer can help them manage their businesses and iron out economic cycles. Gold and silver are generally deemed to money substitutes and therefore dealings I them are regarded as Haram. Options are but insurance policies. Just as Takaful is an acceptable Islamic form of Insurance, options for delivery of commodities by a producer of such a commodity should be acceptable. So also should options or forward contracts on any of the Islamic financial instruments mentioned.

The acid test seems to be the presence or otherwise of an underlying trade transaction to justify the derivative transaction. There will undoubtedly be developments that attempt to make Islamic derivative contracts look and feel like non-derivative contracts. The process is similar to that in the early days of derivatives. There was a problem with the tax treatment of FRAs. So we created a synthetic FRA to overcome the problem. Such a product could be tweaked to serve as an Islamic derivative.

Just as it took decades for conventional banking regulators, tax authorities and auditors to catch up with developments in financial derivatives, it will be a long time before Islamic derivatives are deemed to be acceptable. The developments will prove to be very similar to the developments in derivatives in the late 1970’s. The Islamic banking derivatives winners will be those who remember or research into financial history rather than the rocket scientists.

Conclusion

Whilst Islamic bankers have sought to avoid excessive risk through Murabaha, Ijara and Baisalam, the essential element of most such deals is the linking to a genuine identifiable trade transaction. Islamic finance seekers thus have to open themselves up to their banks even more then their Western counterparts and can only obtain finance for genuine needs. Musharaka and Mudaraba are more difficult to obtain. Firms or individuals cannot borrow to repay another bank. General-purpose finance or borrowing for consumption purposes, overdrafts and swing lines do not exist. Nevertheless, Islamic banks are more risky than their Western counterparts through their riskier equity and trade financing businesses. Credit risk management skills with the comfort of collateral are just not good enough. Project evaluation and equity valuation skills are essential.

Higher than normal reserves are required and diversification of assets is needed to protect against losses and diversification of liabilities is required for liquidity management.

There is the issue of money creation and the multiplier effect through the use of Mudaraba. Some strict proponents of Islamic banking advocate the imposition of 100 per cent reserve requirements.

Such “Islamic” business is not unknown in Western banking. It is called Investment banking and requires sound asset and liability management. There are counterparts in almost all forms of Islamic banking in Western banking. There are Islamic versions of Repos, Leasing, Unit Trusts, Hire Purchase, Equity investments, Venture Capital and Non-recourse project finance.

There are also non-Islamic parallels with Ethical investment fund management. Geof Pearson, the manager of the J. Sainsbury pension fund recently said that “the pensions minister was right ask trustees to disclose their policy on ethical and social issues” (Financial Times, 20 September 1998) and Nottinghamshire County Council is set to allocate 15 per cent of its pension fund in ethical investments (Financial Times, 15 September 1998). The UK’s Co-operative Bank a few years ago proudly advertised its recall of loans to “undesirable” armaments, animal-testing, tobacco and alcohol companies. It appears that only one of its clients was in such businesses but the favourable publicity it received led to a considerable increase in its accounts from “green” clients. Green also just happens to be the Islamic colour. Islamic banks are also supposed to make charitable contributions. In the west there are number of affinity credit cards which make small contributions to the client’s chosen charity. Perhaps, cynically, BCCI sought to display green credentials amongst its clients by having its credit card linked to an environmental charity.

I must stress that this article has not attempted to be a clear treatise on the rules and regulations of Islamic Banking. It should, however, help a non-Islamic bank to satisfy customer actual or potential demand or a non-Islamic organisation to accept Islamic funding.

Glossary

Alwadiah = safe keeping

Baimuajjal = deferred-payment sale

Baisalam = pre-paid purchase

Baitulmal = treasury

Hadith = Prophet’s commentary on Koran

Halal = lawful

Haram = unlawful

Ijara = leasing

Mudaraba = profit-sharing

Mudarib = entrepreneur-borrower

Muqarada = Mudaraba

Murabaha = cost-plus or mark-up

Musharaka = equity participation

Qard Hasan = benevolent loan (interest free)

Qirad = Mudaraba

Rabbulmal = owner of capital

Riba = interest

Shariah = Islamic law

Shirka = Musharaka

This article forms the basis for a chapter in “Key Financial Instruments: understanding and innovating in the world of derivatives” 4 February 2000, Commissioned by Financial Times Prentice Hall

Leave a comment

Also in FINANCE & ECONOMICS

Recent History of Islamic Banking and Finance

Islamic Banking- an Analytical Essay

The Foundations of Islamic Finance

During the short span of a quarter century, a new way of financial intermediation and investment management emerged and gained a sizeable part of the market – between a fourth and a third – in its home base, the Persian Gulf countries. During the same period it spread far and wide reaching Malaysia and Indonesia in the east and the Americas in the west, and a number of Muslim countries adopted the new system at the state level.

It is interesting to ask why it emerged, how it works, what sustains it and what are its potentialities for you and me and the humanity at large. The query is timely as all is not well with our conventional system of money, banking and finance. It has become increasingly unstable, facing recurrent crises. It has failed to help in reducing the increasing gap between the rich and the poor, within nations and between nations. Many think it is partly responsible for increasing inequality.